salt lake county sales tax rate

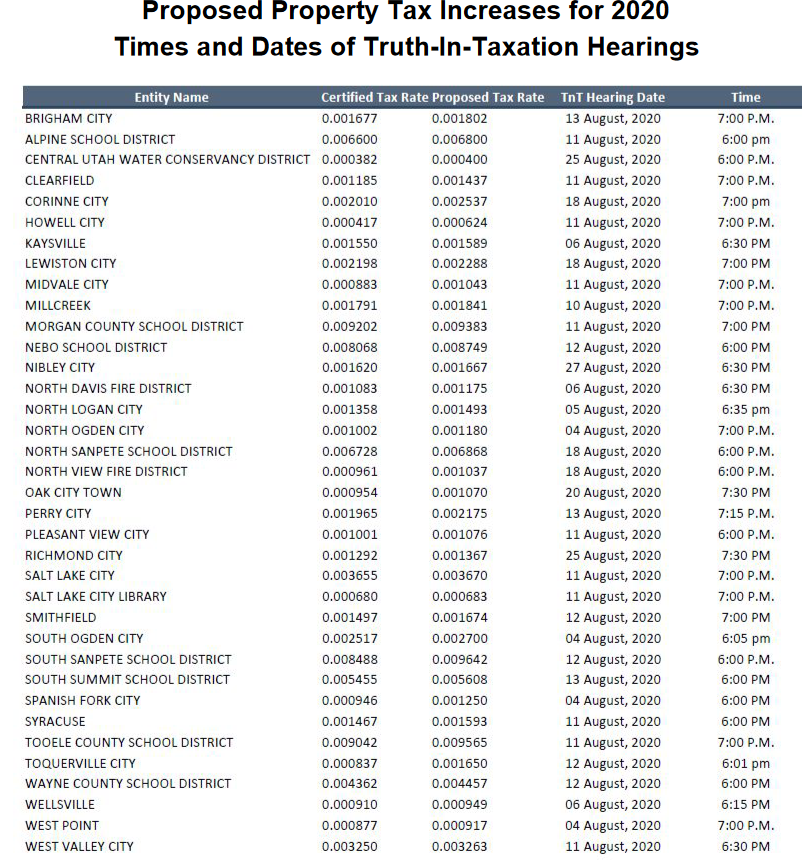

The certified tax rate is the base rate that an entity can levy without raising taxes. 5242017 Page 1 of 9 Prepared by Distribution.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

The minimum combined 2022 sales tax rate for Salt Lake County Utah is.

. If the Salt Lake City School District a taxpayer entity providing a taxpayer service approved an operational budget of 75000 and the total taxable value of all property in the Salt Lake City School District was 15000000 then if you live in that school district the tax rate for the year would be calculated and show up on your official. To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. This is the total of state and county sales tax rates.

If you need access to a database of all Utah local sales tax rates visit the sales tax data page. Cities towns and special districts within Salt Lake County collect additional local sales taxes with a maximum sales tax rate in Salt Lake County of 775. Lowest sales tax 61 Highest sales tax.

Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. What is the sales tax rate in Salt Lake County. The current total local sales tax rate in Salt Lake.

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. State Local Option. Ad Integrates Directly w Industry-Leading ERPs.

21 rows The Salt Lake County Sales Tax is 135. Trenton 03-081 470 100 025 025 010630. Bills and collects all real property taxes administers statutory tax relief programs refunds tax overpayments distributes all taxes collected to local tax entities.

The local sales tax rate in Salt Lake County is 135 and the maximum rate including Puerto Rico and city sales taxes is 875 as of June 2022. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135. Did South Dakota v.

The County sales tax rate is. This is the total of state county and city sales tax rates. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you.

Ad Avalara AvaTax plugs into popular business systems to make sales tax easier to manage. The December 2020 total local sales tax rate was also 7250. A county-wide sales tax rate of 135 is.

The various taxes and fees assessed by the DMV include but are. 4 rows Sales Tax Breakdown. PART 1 OF 2 UTAH CODE TITLE 59 CHAPTER 12 SALES USE TAX ACT COMBINED SALES AND USE TAX RATES Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of July 1 2017 Please see instructions.

This page lists the various sales use tax rates effective throughout Utah. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. UT Sales Tax Rate.

If you would like information on property owned by Salt Lake County please contact Salt Lake County Real Estate at 385-468-0374. The value and property type of your home or business property is determined by the Salt Lake County Assessor. The minimum combined 2022 sales tax rate for Salt Lake City Utah is.

The Utah sales tax rate is currently. Wayfair Inc affect Utah. Provides quality surveying and mapping services to protect preserve and perpetuate property boundary rights.

3 rows Salt Lake County. The Salt Lake County sales tax rate is. Welcome to the Salt Lake County Property Tax website.

The Utah state sales tax rate is currently. Reduce audit risk as your business gets more complex. The county-level sales tax rate in Salt Lake County is 035 and all sales in Salt Lake County are also subject to the 485 Utah sales tax.

Wilson became Mayor in 2019 after serving ten years on the Salt. The Salt Lake City sales tax rate is. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080 special district sales tax used to fund transportation districts local attractions etc. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here.

2022 List of Utah Local Sales Tax Rates. The 2018 United States Supreme Court decision in South Dakota v. In other words it is the rate that will produce the same amount of revenue that the entity.

The current total local sales tax rate in North Salt Lake UT is 7250. Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales taxClick any locality for a full breakdown of local property taxes or visit our Utah sales tax calculator to lookup local rates by zip code.

What Renters Should Do Now Before Purchasing A Property Estate Tax Property Tax Tax Deductions

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Tax By State Is Saas Taxable Taxjar

Salt Lake City Utah S Sales Tax Rate Is 7 75

Utah Sales Tax Small Business Guide Truic

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

An Overview Of The Benefits Of Buying A Home Vs Renting Finance Plan Mortgage Interest Rates Home Buying

Annual Report Finds Utahns Spend 643 Per Person On City Government On Average Utah Taxpayers

Texas Sales Tax Rates By City County 2022

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Utah Sales Tax Information Sales Tax Rates And Deadlines

Quarterly Sales Tax Rate Changes

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation