ad valorem tax florida statute

For leasehold properties the landlord must certify by affidavit to the charter school that the. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the district and to provide for any sinking or other funds established in connection with such bonds.

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Section 19736328a Florida Statutes requires that the.

. And to provide for any sinking or other funds established in connection with any such bonds. Ad Browse Discover Thousands of Law Book Titles for Less. Section 125016 Florida Statutes is a general grant to counties of the authority to impose an ad valorem tax and provides in full.

To pay the principal of and interest on any general obligation bonds of the district. 1 As used in this section. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments.

An ad valorem tax levied by the board for operating. 11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows. 1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole.

Name Spouses name Tax Year 20. 10 Mill means one onethousandth of a - United States dollar. PART ACompleted by each resident.

Body authorized by law to impose ad valorem taxes. Provides for a limitation of the pledge of tax increment financing for a term of 30 years after the community redevelopment plan is adopted or amended up to a maximum of 60 years. VII 4 Fla.

Chapter 197 which apply to general ad valorem assessments property taxes including the. An ad valorem tax or non-ad valorem assessment including a tax or assessment imposed by a county municipality special district or water management district may not be assessed. Florida Statutes 194301 Challenge to ad valorem tax assessment.

FL Taxpayers Ad Valorem Property Tax Exemption Upheld. Section 163387 Fla. Section 1961975 Florida Statutes.

Recently Alachua County denied a longstanding exemption from the Gainesville Area Chamber of Commerce which had been previously. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Save Our Homes SOH Florida Statute 1931551 This constitutional amendment caps the increase in taxable value of homestead property at 3 or the Consumer Price Index CPI whichever is less.

2016 The Line Between Special Assessments and Ad Valorem Taxes 473 least in part they are sometimes challe nged on the basis that they are in substance invalidly imposed property taxes11 B. Any facility or portion thereof used to house a charter school whose charter has been approved by the sponsor and the governing board pursuant to s. An elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct operate and maintain assessable improvements.

An ad valorem tax is a tax assessed upon the value of property. Millage may apply to a single levy of taxes or to the cumulative of all levies. 1 ad valorem taxes.

A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a. 1 In any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value the property appraisers assessment is presumed correct if the appraiser proves by a preponderance of the evidence that the assessment was arrived at by complying with s. 1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole.

Pursuant to the general laws of Florida Emphasis supplied This provision clearly relates to a direct tax imposed directly upon property generally known as a property tax or ad valorem tax. Annually an ad valorem tax of not exceeding 1½ mills may be levied upon all property in the county which shall be levied and collected as other county taxes are levied and collected. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION.

1961983 Charter school exemption from ad valorem taxes. Collection of non-ad valorem assessments shall be subject to all of the collection provisions in. See Collier County v.

100233 7 shall be exempt from ad valorem taxes. Section 163385 Florida Statutes. An ad valorem tax or non-ad valorem assessment including a tax or assessment imposed by a county municipality special district or water management district may not be assessed separately.

1920011 2015 Ad valorem tax means a tax based upon the assessed value of property. Ad Get Access to the Largest Online Library of Legal Forms for Any State. According to Chapter 197122 Florida Statutes all owners of property shall be held to know that taxes are due and payable annually and are charged with the duty of ascertaining the amount of current and delinquent taxes and paying taxes before the date of delinquency.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Under the language of s. Except in pursuance of law and s.

Florida Property Appraisers notoriously can change their mind when it comes to exemptions even when those exemptions have been in place for years prior. This protection is void if the home was sold rented or there is a change in ownership status. Name Spouses name Tax Year 20.

Portability of Save Our Homes SOH Benefit. 1a Any real estate that is owned and used as a homestead by a veteran who was honorably discharged with a service-connected total and permanent disability and for whom a letter from the United States Government or United States Department of Veterans Affairs or its predecessor has been issued certifying that the veteran is totally and permanently disabled is exempt from. Set forth in 19736323 and 4.

If you do not receive a bill in November call our office at 352 498-1213. Florida Administrative Code. TAX COLLECTIONS SALES AND LIENS.

Effective 1121 Page 1 of 2 INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION HOMES FOR THE AGED Section 1961975 Florida Statutes PART ACompleted by each resident. State 733 So2d 1012 1014 n. HOMES FOR THE AGED.

Community redevelopment agencies created after July 1 2002 are limited to 40 years. 2 Fla1999 The Florida Constitution requires a just valuation of all property for ad valorem taxation Art. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

January Is Property Tax Month In Most States Property Tax Florida Real Estate Property

Florida Real Estate Taxes What You Need To Know

Florida Revenue Floridarevenue Twitter Disaster Preparedness Hurricane Prep Preparedness

Acceptance And Certification By Depository Probate State Of Florida Acceptance

Quit Claim Deeds Corporate Home Ownership And The Homestead Exemption Property Tax Adjustments Appeals P A In 2021 Home Ownership Homestead Property Property Tax

Florida S State And Local Taxes Rank 48th For Fairness

Florida Dept Of Revenue Nonprofit Org Parents As Teachers Teacher Organization Parent Teacher Association

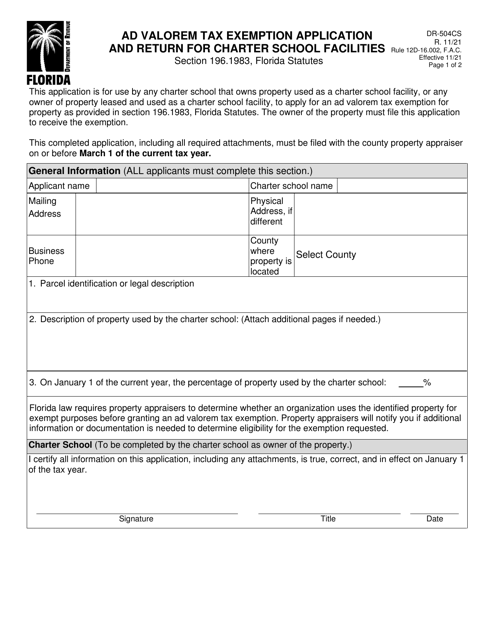

Form Dr 504cs Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Charter School Facilities Florida Templateroller

Pin By Claudia De Lillo On School Back To School Back To School Sales Holiday Items Back To School

9 Tips For Buying A Vacation Home Sarasota Real Estate Vacation Home Real Estate Tips

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Dept Of Revenue Property Tax Taxpayers Exemptions Filing Taxes Property Tax Revenue

Broward County Florida Security Deposit Law Florida Law Broward County Florida Broward County

Pin By J Elizabeth On 501 C 3 Charitable Organizations Guide Fl Charitable Organizations Public Information Organizing Guide

Florida Dept Of Revenue Child Support Program Child Support Supportive Child Support Laws